Why The National Debt Matters

The national debt grows by $68,836.62 per second, $4,130,196.92 per minute, $247,811,815.11 per hour, and $5,947,483,562.72 per day. Currently, the total national debt is $37 trillion.

The last time the US had no debt was 2001. For me, that is longer than I have been alive, but it should be considered longer. There was a brief period without debt from 1998 to 2001 because of the dot-com bubble, when money was flowing into the U.S. economy from internet investors.. Before that brief period, the U.S. had not been debt-free since 1969. As a nation, for nearly a lifetime, we have had so much debt that it is hard to fathom how it affects us. The national debt feels like something that has always existed.

The U.S. national debt is how much the government spends compared to how much it makes in revenue, mostly through taxes. When spending exceeds revenue, the government must borrow money. They do this through financial tools like bonds, where you give the government money and then, after a set amount of time, you will get that money back with interest. A surplus is when the government makes more in revenue than it spends. We have not had a surplus for 23 years, since 2001. Going into debt is borrowing from the future; you are giving your people good times now to take away the money that could have been used in the future. But eventually the future becomes the present, and that is where we are now.

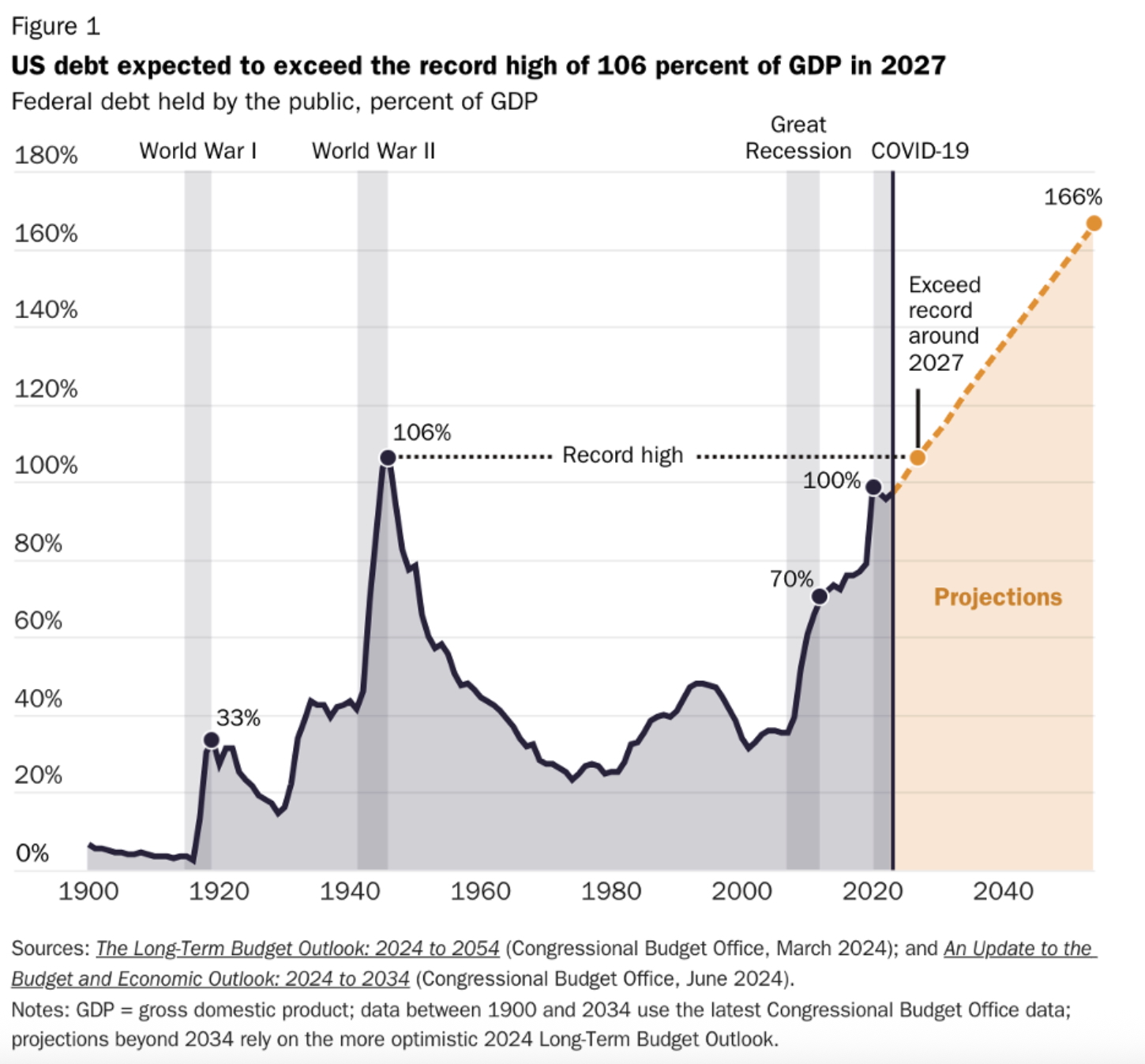

The U.S. is currently at 125 percent debt to GDP (ratio of debt to revenue). Experts consider 113 percent risky.

We have a lot of things to our advantage that other countries do not. For one, the dollar is the global reserve currency, which means when two countries are doing trades and what they are trading back and forth (i.e., wood for currency); when the trade is not 1:1, they supplement the remaining cost needed to balance the trade with U.S. dollars. This gives America a lot of leeway, as it makes the U.S. debt global debt. When times in America are hard, times everywhere are hard. When America weakens its currency, all currencies weaken. It is thus in the interest of global markets to keep the dollar strong.

But how did the debt get so large? Social Security is a program that helps support retirees and disabled individuals financially. When social security was first introduced, the federal government made enough money from the taxes it collected to cover how much the program cost. But as the older generations retire and start to use their social security, the money coming in from younger working people through taxes is not enough; thus, the government goes into debt.

Forty percent of military spending worldwide is done by the U.S., more than double the country that spends the second most, China. The U.S. military runs on a “use it or lose it” spending strategy, where the federal government gives a military base a budget, and if the entirety of that budget is not spent, then the military base is given less money to use the next year. A strategy that was meant to save money ends up costing taxpayers more, because when a military base sees that they have not spent the budget, they spend the surplus money to meet the “quota.” But that is only half the story. Over half of the Department of Defense budget goes to private contractors like Lockheed Martin, Boeing, RTX (Raytheon), and more. These companies are known to artificially raise the prices of what they sell to the U.S., knowing that the U.S. will spend to have the best military in the world, no matter the cost.

The government cannot just print money to pay down the debt. Printing money weakens our currency and makes inflation rampant.

The U.S. also cannot just avoid paying creditors. Defaulting will make the U.S. a risky investment. If countries see that America cannot pay back their investments, they will stop investing.

We can already see the beginnings of this happening; Moody’s (a credit rating company that rates countries on how safe it is to invest in them) recently downgraded the U.S. from Aaa, the top rating, to Aa1. This is the first time Moody’s has downgraded the U.S. since 1917. The other large credit rating agency, S&P Global Ratings, downgraded the U.S. years ago.

Part of the reason it is difficult for government leaders to pay down the debt is that programs that help the less fortunate would not be funded. In times of struggle, like recessions and depressions, it is understandable and necessary to go into debt to support people who need it. But when you are going into debt in the good times, the times of economic growth and prosperity, what are you going to do in the bad times? Precisely when the government is making a surplus is when the debt should be addressed, but that has not been the pattern.

Some economic strategists suggest we will outgrow our debt, that the U.S. is such an economic force, and with the advent of modern technology like AI, which the U.S. is the leader in, the economy will grow faster than the debt we’re taking on. Nvidia–the largest company in the world, thanks to the AI boom, is worth $4.62 trillion, OpenAI (makers of ChatGPT) is worth $500 billion, Meta is worth 1.5 trillion, and Microsoft is worth $3.7 trillion. All together these companies are worth about $11 trillion. The argument that the U.S. will outgrow its debt relies on speculation and hope that in the coming years big tech companies like these will grow tenfold in size, and pay their share of taxes, and those taxes will be used to help pay down the debt.

The debt is a looming threat that seems impossible to defeat, especially since few in power seem willing to address it. There seems to be nothing average people can do but stay informed and vote for people who want to fix this problem. I know I will.