Is Going to College Really Your Best Option?

Gallery

Any college student will tell you; the financial baggage that comes with getting a degree is almost too much to handle. Students spend thousands of dollars a year to get a higher education only to end up finding themselves drowning in loans before they even have a job. The worst part? Many of these students spend the rest of their lives spending the money they make on paying back their loans.

Many students whose parents make just above a certain amount of money a year are not granted financial aid from the government, leaving the students and their families with the bill. Although these families may make more than the average, the cost of sending a child, let alone more than one child, to college is extremely expensive. This is especially true for students who live away from home. The cost of the dorm room, meal plan, tuition, textbooks, and spending money (not that they have much of this, anyways) can easily cost them tens of thousands of dollars for a single semester without financial aid or scholarships.

Not only can this leave students with an unworldly amount of debt by the time they finish, but it can also hinder their education. Many of these students cannot attend the school they feel fits their needs because of the cost.

“Finding the right college for you doesn’t depend on what degree you want, or where is closest to home. It’s about which school is the cheapest and offers you the most money as far as scholarships and grants go,” says Shabir, student at Henry Ford College. “Would I like to attend a four year university? Sure. Am I smart enough to go to one of the top schools in our state? Most definitely. But can I afford to? No, I can’t. Unfortunately for me, I feel like I’m unable to live up to my full potential due to my current financial status, which is more than likely going to affect me in the future.”

Shabir’s parents, like many others, make above the amount set by the government to qualify for financial aid. The result? He is unable to attend the school he wants to. Not only that, but he is forced to attend a college (that was once a community college) that doesn’t completely offer a four year degree for every field. Of course, these colleges are extremely helpful for low-income students, or for those who may have struggled in school and didn’t meet a certain grade point average. Matter of fact, these schools do offer great teachers and programs. However, any student who attends a school like Henry Ford College will tell you, if they had the opportunity to transfer to a four year university, they would.

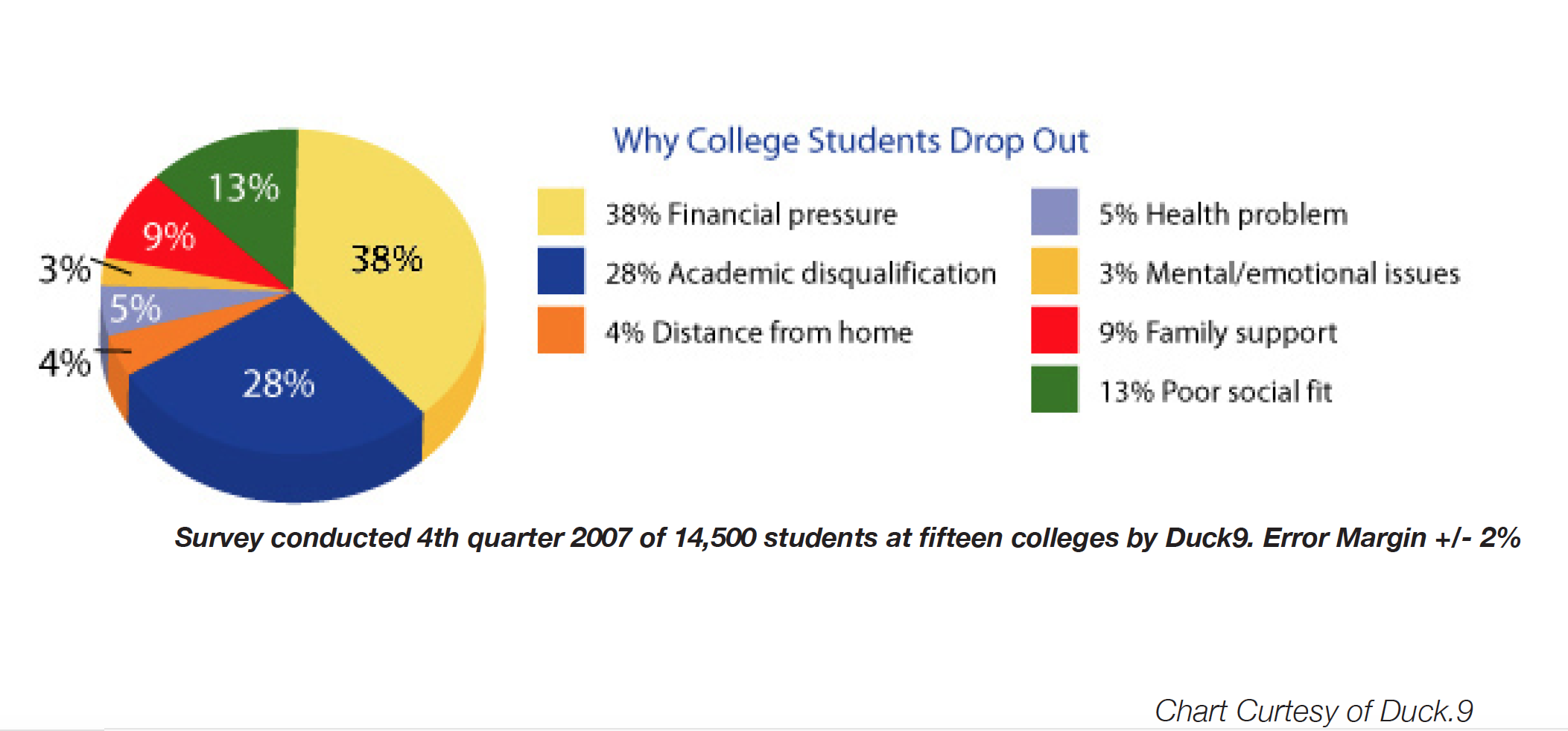

Debt is a drag, and borrowing thousands of dollars in loans isn’t even an option for some people. This can lead to students having no choice but to drop out of school and find an alternative option to college. Although this may work out well for some people, it hasn’t gone as planned for Angella, a former nursing student at Oakland University in Rochester, Michigan.

“I’ve always loved working in the medical field. When I was in high school, I used to volunteer at Beaumont hospital, which was no more than a 10 minute drive from my home. It was amazing, being able to spend time with people who do so much everyday to save lives was incredible. But I have to say, the best part was bonding with the patients. Although so many only had a limited amount of time left, they were so joyful and full of energy. It was inspiring.” Angella says, holding back tears. This humbling experience convinced her that her purpose in life was to help others. “I didn’t want to be a doctor, I knew that for sure. I didn’t want to spend so much money, and time, in medical school. I felt like becoming a nurse was my best route, so I went with it.”

In August of 2015, Angella began attending the nursing program at Oakland university. She did not have any financial aid, scholarships or grants. She did, however, have the motivation and drive to go to school and get her degree. She went to school at Oakland for two years, but in December of 2016, things took an unfortunate turn.

“I was two years into school, and $50,000 in debt. I couldn’t pay the money back yet, and I was told I couldn’t take out anymore loans until I begin to pay part of what I owed. I didn’t know what to do. I thought about having a family member take out a loan for me, and I would pay them back, but I couldn’t get myself to ask someone to do something like that for me. When the time came and I had to pay for the upcoming Winter semester, I realized that I couldn’t,” Angella says as she begins to tear up yet again. “It was difficult. I really wanted to go to school and finish what I had started, but I couldn’t. I had no choice but to drop out for the time being. The hardest part was telling my family. They seemed extremely disappointed, we all really thought I’d go far. Look at me now, I’m a former nursing student who is $50,000 in debt with nothing to show for it.”

But, Angella still has hope. She continued on, “I currently am working full-time to make some extra money to start paying back my debt and hopefully go back to school in January of 2018. That’s the goal right now; make enough money to go back to school. I don’t care about anything else really.”

Although both Shabir and Angella may be having a rough time, both are optimistic, saying they plan on continuing school and getting the degree they want. Money may be tight, but they both strongly believe in higher education, giving them the motivation and hope they need to get through this trying time to finish school one way or another, however long it may take them.